Money has an all-consuming desire to materialize, either in the form of profits or tangible products. No matter who controls the wealth, there is always a social or financial incentive to spend the money, and thus, money always desires to materialize as predictably as electricity desires to travel along conductors. When it comes to federal policies like quantitative easing or business “loans,” the free money that is doled out to the politically connected bourgeois and their institutions always finds its way back into the economy. The materialization of unwarranted money has a different effect from the typical inflation we’re familiar with when the recipients of this money are overwhelmingly the bourgeois and the corporations. With all this newly minted money at their disposal, the powers that be find ways to avoid cash drag, in which their wealth that is not invested is hurt more severely by inflation (non-returning wealth is simply eaten away by inflation, as opposed to investments that have higher return rates than inflation rates). Typically, this newly minted and gifted money is sunk into pre-existing assets such as housing, stocks, and other forms of property, due to the simple fact that it’s easier to invest in proven and pre-existing properties than build new ones that don’t have that proven track record and lack the same liquidity in their development phase. Thus, due to all this money being pumped into places it shouldn’t be, asset inflation happens, in which the market’s valuations for property grows out of proportion to their actual value. The properties do not suddenly become more profitable or lucrative, but rather that their prices are just inflated because the money that investors have desperately needs a place to go. In this way, money materializes because if it doesn’t, it has an actual half-life that depends on inflation and is, on top of that, useless if it’s not spent.

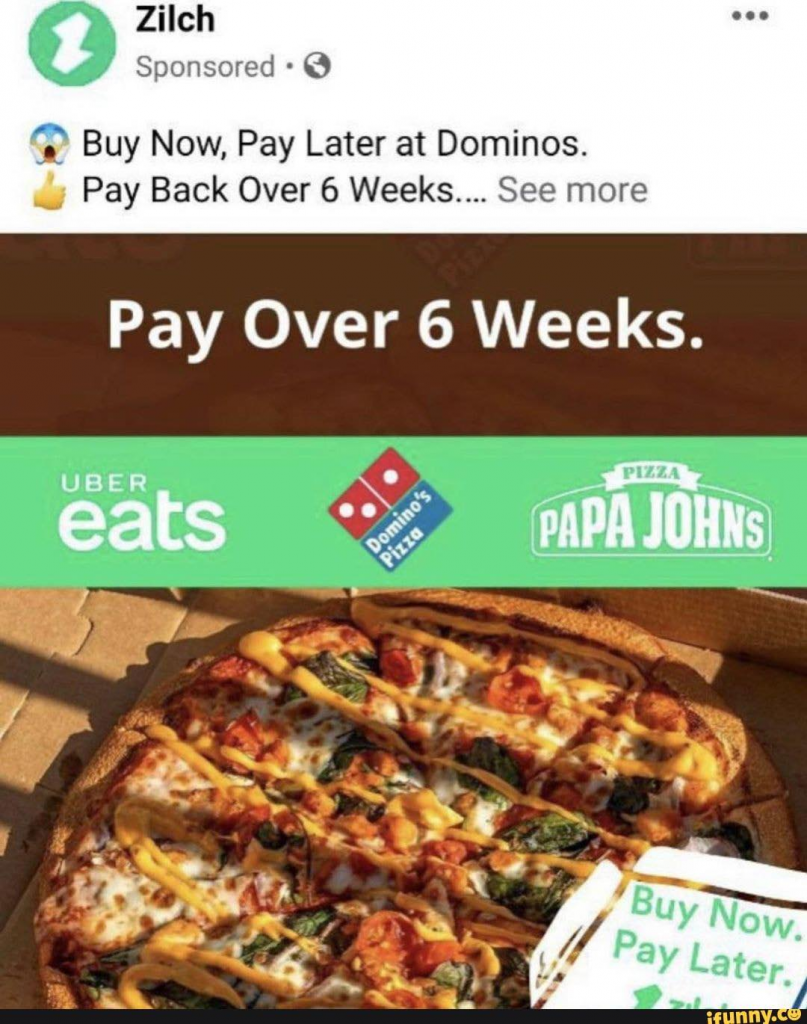

On the consumer side, money has the urge to materialize in order for people to acquire status and live how they want. People scarcely buy expensive things for their flavor or utility but rather because it accentuates how they appear to others. It’s rare in the modern world for misers to exist, and this probably ties into the effect that social media has on people. While I’m part of the “digital native” subset of millennials, as someone without a lot of social media, I lose contact with people I’m not seeing very often usually. This results in my consumption, I feel, being lowered by the fact that the people I’d want to impress are long gone anyways. For those on instagram and Facebook, conspicuous consumption takes on a far more amplified flavor, in which everyone that is friends with you or follows you is much more likely to see how you’re living. This ability to showcase your consumption on a stage larger than ever before has resulted in a surge of people financing their lifestyles, to the point that many people can’t afford what they have. As people continue to finance their vehicles, homes, and even clothing in the 21st century, more and more the urge for money to materialize appears on the consumer side. For proletarians, especially men, conspicuous consumption allows us to acquire what we desire in a more primal sense. Things like shelter, mates, and so on are acquired with our earnings and lost without them. While some may regard flashiness as stupid, I just see it as a matter of humans flaunting their feathers in a fashion similar to peacocks. I’m not judging the peacock for showing off its feathers to attract mates and intimidate rivals, and for the same reason, I’m not judging humans either because we’re still animals with the same wants at the end of the day. With the ability to finance everything in our lives now, including pizza, we are witnessing an explosion in consumer inflation due to the cheap money available to people. Putting the peacock metaphor to use, social media for humans today is similar to putting a peacock within a house of mirrors, with the reflections largely never being interacted with, as the peacock struts back and forth endlessly showing itself off, trying to compete with reflections doing the exact same thing.

Moving on from pizzas and peacocks, understanding where the money goes and identifying the interests and material incentives of those it goes to, can allow for you to understand where the inflation will occur. If you’re smart about it, you can ride the bubbles of inflation, from investing in consumer-oriented ETFs to investing in real estate holding companies and so on, hopping from bubble to bubble. Regardless of how you profit from the inefficiencies inherit in money materializing in unproductive ways, the damage caused by money materializing in inflationary ways is very real indeed. The global economy is locked inside the largest economic bubble in history, with China, African countries, and the United States having gratuitously overextended themselves in this era of gifted money, plentiful subsidies, and ultra-low interest rates. Adding onto the talk about the looming recession, Japan has been in a recession nearing three decades in length due to overextending its credit during its debt-fueled “economic miracle” and due to a rapidly aging population, and many countries are bound to follow suit in the coming years since they have very similar problems now. When money materializes in reinvestments into development and research, it works great, but when money is reinvested into people peacocking themselves into debt, corporations treating houses as assets, and companies spending their free government money on stock buybacks to inflate prices. that’s when things can become very problematic. Rather than growing the tangible economy or doing anything productive, more and more people orient their livelihoods around living off of the inflation on things that aren’t supposed to be assets in the first place. If labor creates all wealth, then we ought to see speculation as dangerous in that it disrupts the smooth economic processes of society in order for some people to try to make a labor-free buck through unproductive methods. While many capitalists lump hate on welfare recipients for being lazy and living off money that they didn’t work for, it’s about time socialists begin to look at speculators and the beneficiaries of speculation in the same way on very real things like stock prices and housing.